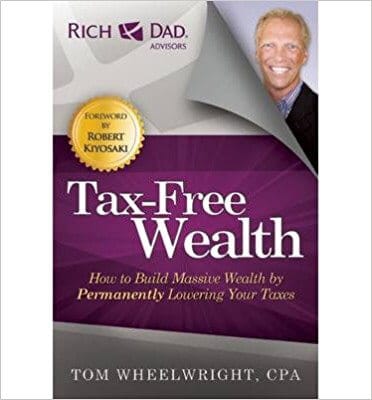

BookYap’s Review: I have been practicing what I learned from the “Rich Dad’s” educational books for some years now. These books teach valuable things our school system doesn’t, especially in finance and investing. Many of us have read, or heard about the book “Rich Dad Poor Dad” by Robert Kiyosaki. This book “Second Chance” is also written by Kiyosaki. In this book, Kiyosaki uses many real statistical reports and graphics to further emphasize what he has been trying to point out to the public since “Rich Dad Poor Dad” came out in 1997. If you like the first book, you will love this new one. You may also be disturbed by the facts he points out about the dangerous direction our United States government is taking us.

Table of Contents:

Chapter 1: Why The Rich Don’t Work For Money

If the house you live in is your only investment while you are working for a corporation for a bi-weekly paycheck, the facts this chapter points out may make you break a sweat. But the good news is, you will know what is most likely coming ahead of time to better prepare for it.

If the house you live in is your only investment while you are working for a corporation for a bi-weekly paycheck, the facts this chapter points out may make you break a sweat. But the good news is, you will know what is most likely coming ahead of time to better prepare for it.

One sentence I agree with the author is this: “Other countries offer free higher education. In America, we create debt slaves out of our students.” page 20. Our United States government built the system to get our best 10 to 20 years of hard work after graduation through student load debt repayments, while driving up inflation which weakens our hard-earned money, after tax. I’m not trying to be a pessimist here, but those are the facts. Just read this book, and you will know what I mean.

Chapter 2: The Man Who Could See The Future

I read this somewhere, a long time ago: “if you want to predict the future, look at the past.” I couldn’t agree more. As people, we tend to forget things, after a decade or two. Also, after a couple of decades the people of the next generation often think their time will be different than the older generations (their parents); thus, the younger generations often make the same mistakes, in a different way, as their elders. Just take the housing market in the last 100 years for example. Boom and bust keep repeating, almost in regular intervals.

In this chapter Robert Kiyosaki tells a story of a period in his past when he was struggling, which helped shape his viewpoints and reach the success he’s achieved today. He shared his memory of another giant, Mr. R. Buckminster Fuller, who was kind of his mentor when Robert was young. Personally, I like to learn the story of the giants who’ve worked smart and made it through with flying colors. From Warren Buffet, Steve Jobs, Bill Gates, etc. I have a great respect for Robert Kiyosaki for sharing his insights on the critical things our school system should teach us, but doesn’t. Especially, when he points out what the U.S. government has been doing to us. This chapter may provide you with a different frame of view, a different point of reference, from what you may have learned before.

I like Robert Kiyosaki’s new approach in this book, which reads like a personal interview with him. In this book, he answers questions one at a time to help you learn the past, understand the now, and know what you should prepare for in the future, to overcome the turbulence ahead of us. It’s a great read. As I’m writing this, I’m already halfway into the book…lol.

Chapter 3: What can I do?

Two things I found valuable as takeaways in this chapter are:

1) To be a success in business, look for a solution to address an existing problem and serve more people, instead of looking to make more money. If you do a good job solving people’s problems, the money will naturally come. Here’s an article I wrote to advise new startups:https://proweb365.com/10-things-entrepreneurs-can-do-to-improve-odds-for-success/

2) Grunch of Giants is the book you should read to get a clearer picture of what Robert T. Kiyosaki is trying to convey. Grunch of Giants is a short book, packed full of eye-opening insights.

Chapter 4: What is a Heist?

This chapter points out facts backed with real statistics that will disturb most who are not yet aware of what our educational system and government have been doing to us for a long time. Although I have been aware of this for a while now, and I’m constantly working hard to get the upper hand on their game, I feel bad for the majority of honest working people who are still in the dark, unaware of what has been happening. If you want to get a glimpse of light at the end of the tunnel, you need to read this chapter and the book Grunch of Giants.

Chapter 5: The Next Crash

I don’t believe anyone can predict the exact time of an economic crash. However, I do believe that those who take the time to learn from the past while carefully observing current events, should be able to predict the outcome to a certain extent, even if they can’t predict exactly when an event will happen. There is always boom and bust in the economy, and knowing which direction it is likely going ahead of time to be able to prepare for it is, is the wise approach.

Chapter 6: How Much is a Quadrillion?

One of the golden nuggets I learned in my early years reading Robert Kiyosaki’s writing, is the importance of observing things that surround us, with our minds, not just with our eyes, in order to make intelligent decisions. In order to improve this ability, we need to really read and research the right content (even play the CashFlow game) so we can recognize true facts from the many false or misleading claims floating around out there. This knowledge will help open your “mind’s-eye,” so you can connect the dots and see things for what they truly are.

This chapter gives us a great example of some “invisibles” many of us are unaware of, which have taken advantage of us, over a long period of time. But you should not be frustrated with what you discover in this chapter; because you can use your intelligence to counter the invisible giants, and come out on top.

Chapter 7: How to See The Invisible.

This chapter points out the incorrect words we often use to describe things which are actually shackles that can hold us back. One popular example: everyone calls their home an “asset” while the truth is, it is a “liability.” An asset is something that puts money in your pocket each month, while a liability is something that takes money out of your pocket each month.

In addition, there is a short story about Chicken Little and the Fox in this chapter that demonstrates how the invisible hands of the “giants” impact us. To help prove his argument, Robert Kiyosaki shows us a brief history of our US government’s actions from 1961 to today, with statistical facts to support it.

To be continued…